Sustainable Development

Our aim is to reduce our negative social, economic and environmental footprints while enhancing

the overall value we create as a leading brand.For Loans, your local authority should’ve already

contacted you if you’re eligible. You might want to check their

website if you haven’t received anything.

In particular, they’ll need your up-to-date bank details in order to make the payment,

so you might want to get in touch tocheck.

The Bank of England

Promoting the good of the people

of the United Kingdom by

maintaining monetary and financial stability.

Our Financial Policy Committee (FPC)

meets to identify risks to financial stability

and agree policy actions aimed at safeguarding

the resilience of the UK financial system.

Published on 11 December 2008

The Financial Policy Committee (FPC)

aims to ensure the UK financial system is prepared for,

and resilient to, the wide range of risks it could face — so

that the system can serve UK households and

businesses in bad times as well as good.

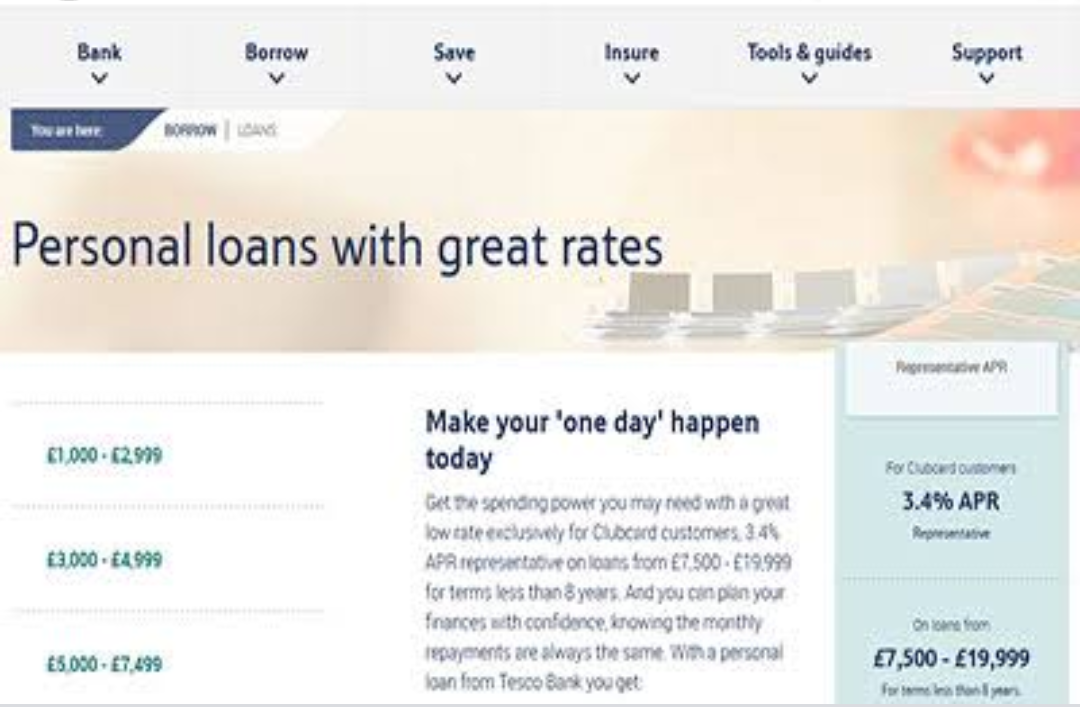

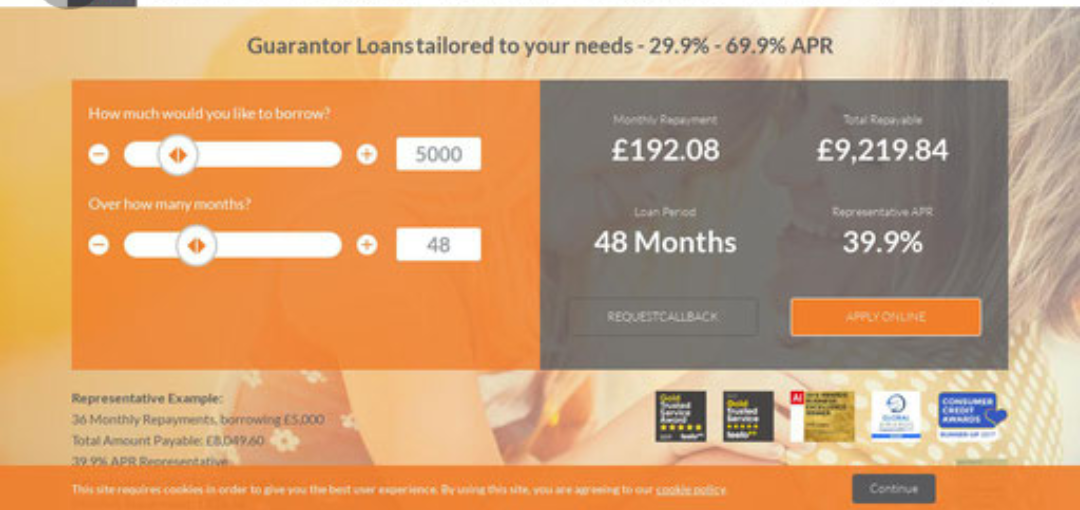

RATES RELIEF AND LOAN

Funding your business can be difficult, whether that’s getting

it off the ground, or growing a successful enterprise.

A variety of government Loans

are available to address just this need, and should be investigated by all businesses.

Read this article to learn about the financial support

that’s available to your business..

Protecting yourself online is easy if you take the time to find out what you can do to stay ahead of

hackers and other elements of the criminal web.

ABOUT US

A financial provider, was incorporated under the Banking Act 2004 (Act 673) as a private limited company and commenced universal banking operation in 27 july 1694. Regional funding grants .

CONT ACT INFO

Address: Bank of England

222-010-0000

Email:

inquiriesbnk ofengland @gmail.com